Fica tax calculation 2023

Start the TAXstimator Then select your IRS Tax Return Filing Status. Next years estimate For 2023 the trustees estimate that the taxable wage base will be 155100 up 8100 from the current wage base of 147000.

Llc Tax Calculator Definitive Small Business Tax Estimator

Tax rates are set.

. 250000 x 145 00145 3625. Social security taxes 823980 this is calculated by multiplying. FICA tax includes a 62 Social Security tax and 145 Medicare tax on earnings.

The aforesaid FICA tax calculator is based on the simple formula of multiplying the gross pay by the Social Security and Medicare tax rates. 50000 x 09 0009 450. Ad Being an Industry Leader is Earned Not Given Business Planning Simplified.

The amount that you should withhold from the employee. See your tax refund estimate. Beginning in 2023 the taxable maximum will be increased by an additional 2 per year until 90 of taxable earnings are covered.

Well calculate the difference on what you owe and what youve paid. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP.

Social Securitys Old-Age Survivors and Disability Insurance OASDI program and Medicares Hospital Insurance HI program are financed primarily by employment taxes. If youve already paid more than what you will owe in taxes youll likely receive a refund. Over a decade of business plan writing experience spanning over 400 industries.

This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. Since the rates are the same for employers and. In addition to your Social.

This projection is based. Heres how you would calculate FICA taxes for this employee. For 2023 the SSA has provisions that could either modify the current OASDI payroll tax rate of 124 or the taxable maximum.

You can calculate your FICA taxes by multiplying your gross wages by the current Social Security. You can calculate how much youll pay for FICA taxes by multiplying your salary by 765 taking into account any exceptions or limits that might apply to your situation. The SSA provides three forecasts for the wage base.

CNBC reported that a recent congressional. To calculate your employees FICA tax multiply the employees gross pay by the Social Security tax rate 62 and the Medicare rate 145. Normally these taxes are withheld by your employer.

Federal Income Tax Return Calculator Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax. However if you are. Employee 3 has 37100 in eligible.

Beginning in 2023 a 4 payroll tax rate on. According to the annual report for 2023 the wage base will be 155100 up from 147000 in 2022 and 142800 in 2021. For example The taxable wages of Mr.

In 2022 only the first 147000 of earnings are subject to the Social Security tax. What is FICA tax. 9114 3625 450 13189.

2022 Self-Employed Tax Calculator for 2023. Use this calculator to estimate your self-employment taxes. The FUTA tax liability is based on 17600 of employee earnings 4900 5700 7000.

Instructions for Form 8959 and Questions and Answers for the Additional Medicare Tax. Ad Being an Industry Leader is Earned Not Given Business Planning Simplified. Beginning in 2023 the taxable maximum.

Additional Medicare Tax Withholding Rate. To calculate your employees FICA tax multiply the employees gross pay by the Social Security tax rate 62 and the Medicare rate 145.

Easiest 2021 Fica Tax Calculator

Tax Calculator Estimate Your Income Tax For 2022 Free

Corporate Tax Meaning Calculation Examples Planning

Easiest 2021 Fica Tax Calculator

Estimated Income Tax Payments For 2022 And 2023 Pay Online

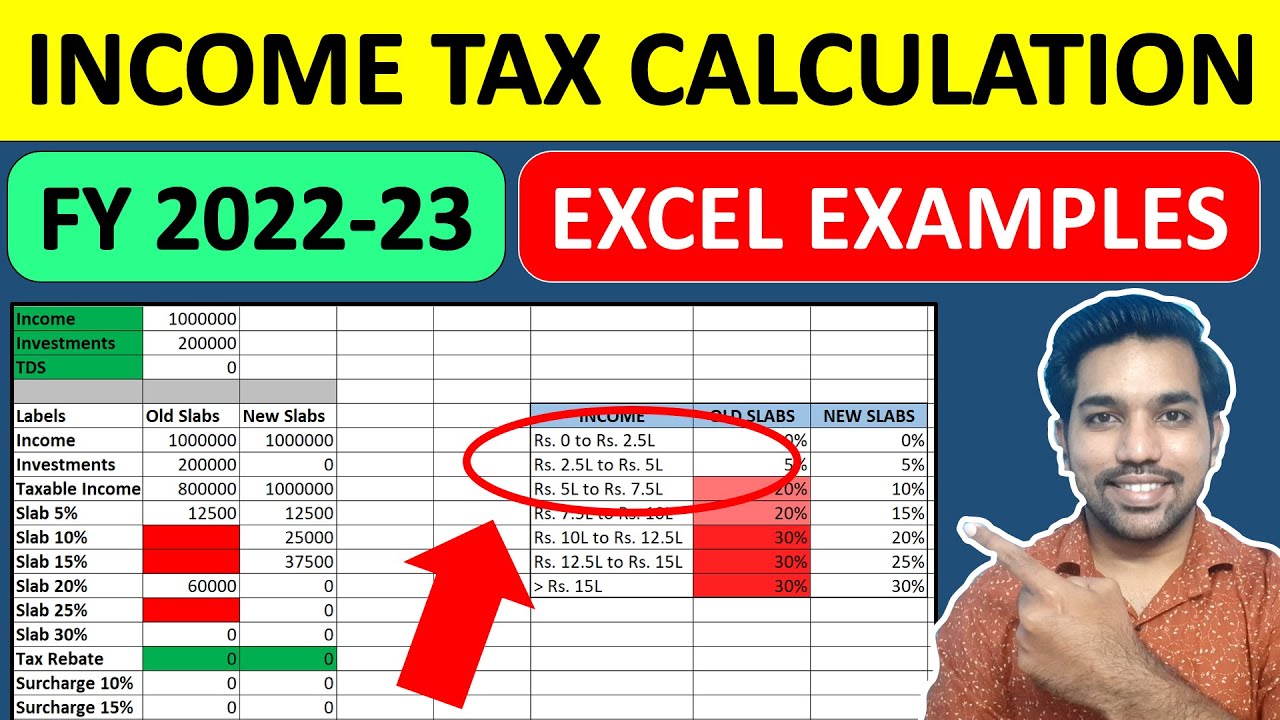

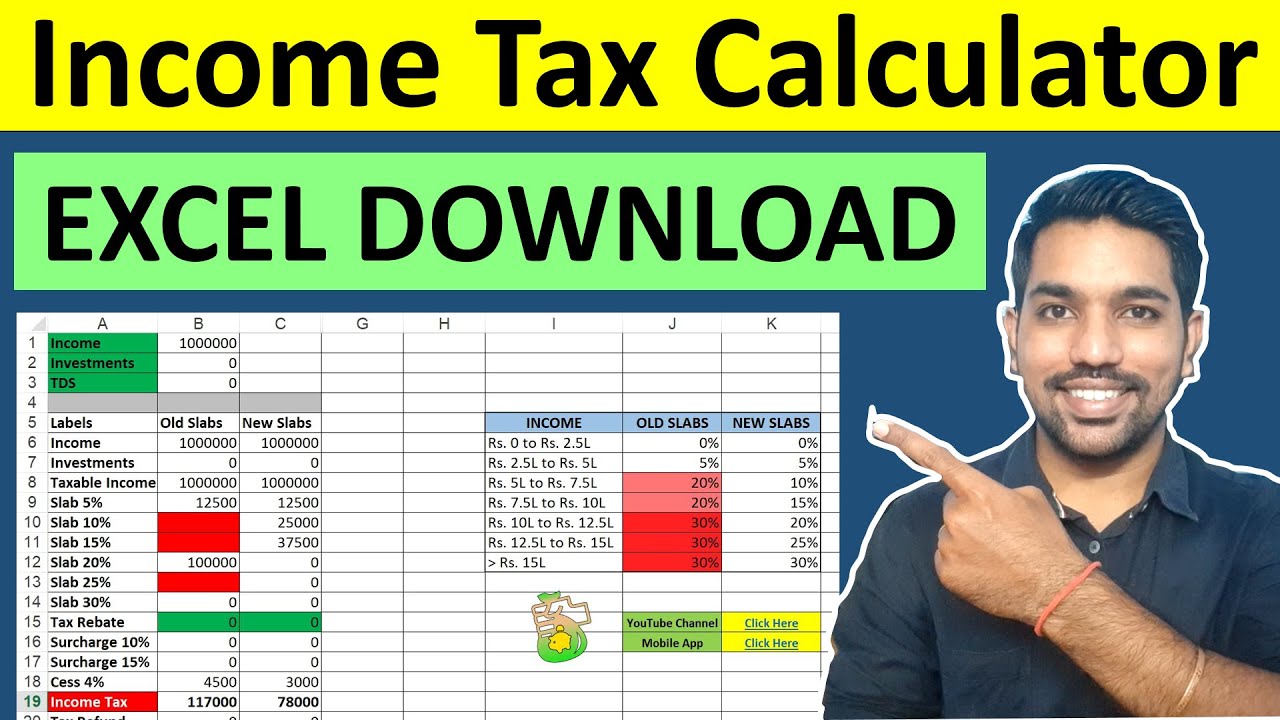

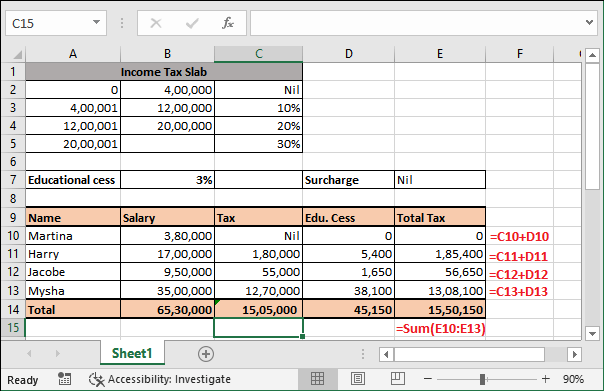

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube

Taxable Income Formula Examples How To Calculate Taxable Income

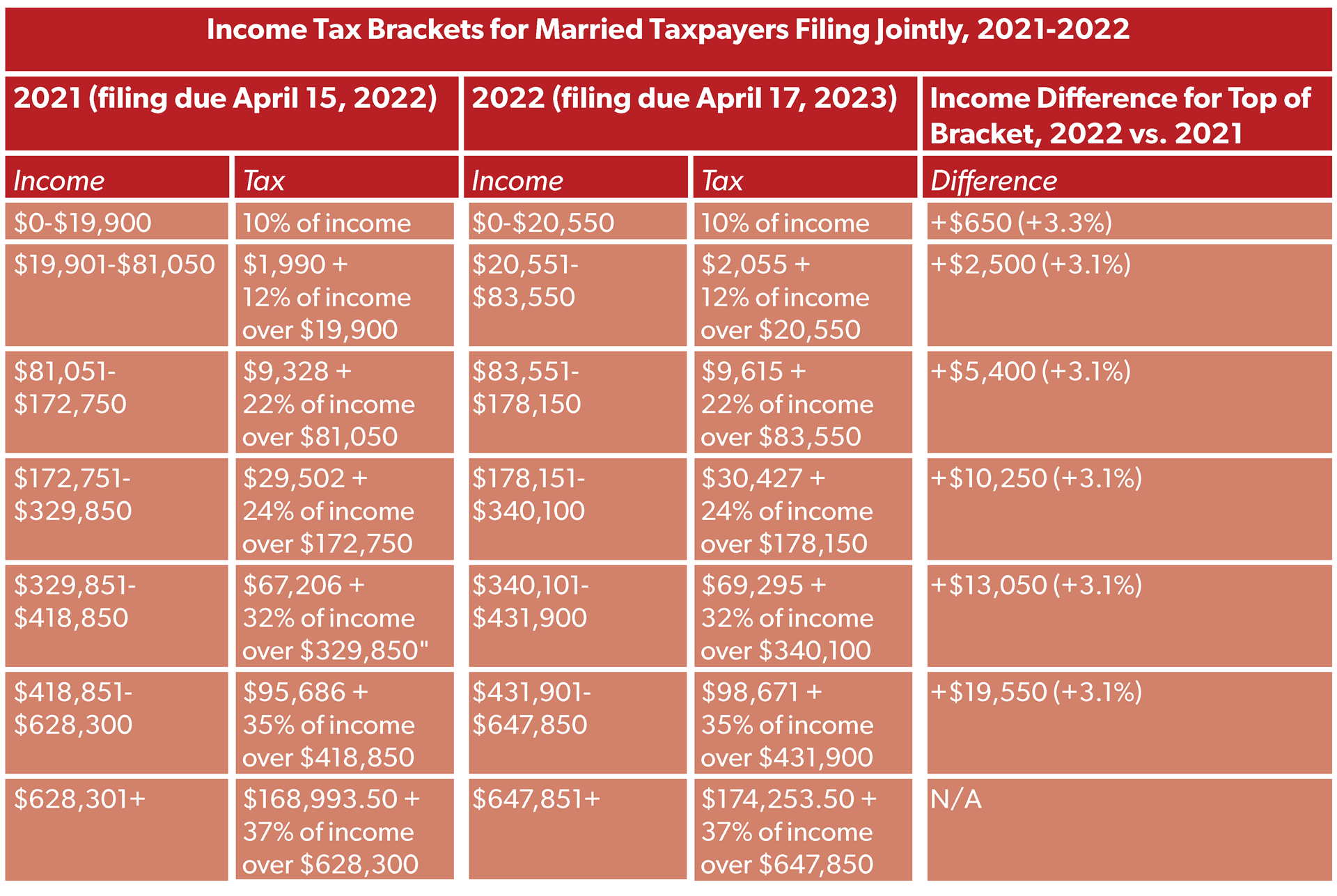

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

Senior Citizen Income Tax Calculation 2021 22 Excel Calculator Examples New Tax Slabs Tax Rebate Youtube

How Is Taxable Income Calculated How To Calculate Tax Liability

How To Calculate Fica For 2022 Workest

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube

Income Tax Calculating Formula In Excel Javatpoint

Pin On Budget Templates Savings Trackers

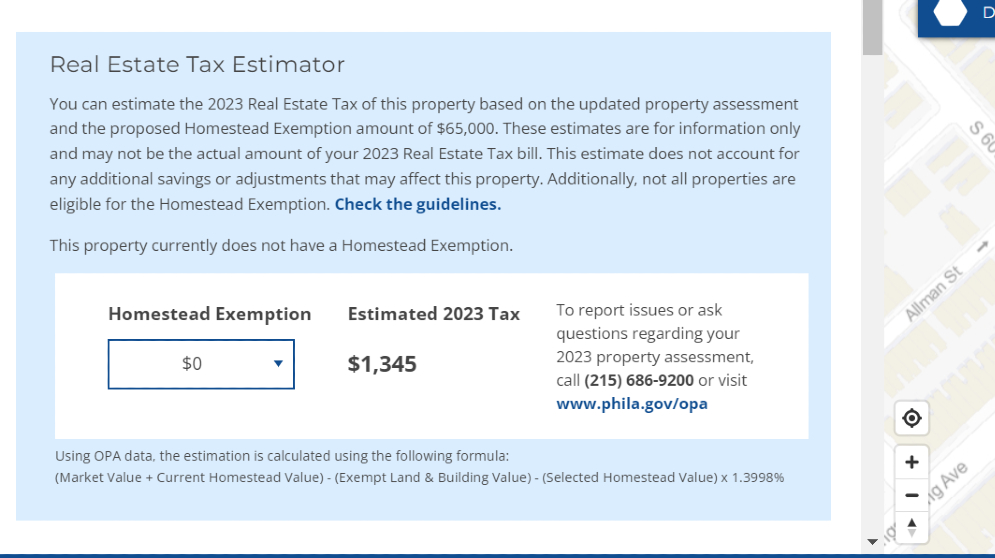

Estimate Your 2023 Property Tax Today Department Of Revenue City Of Philadelphia

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Capital Gain Tax Calculator 2022 2021